If you’re like many of our customers you may wonder how to recover depreciation from an insurance claim. First it is important to check if you have recoverable or non-recoverable depreciation. In most cases deprecation is recoverable, but sometimes it is non-recoverable because the policy owner may have an Actual Cash Value Policy, the repairs/replacement were not done before a certain deadline, or other reasons. You can verify if your depreciation is recoverable on your insurance adjustment, or on your insurance declaration page or policy.

During the adjustment, you will receive paperwork that is often times helpful in identifying the particulars of your policy.

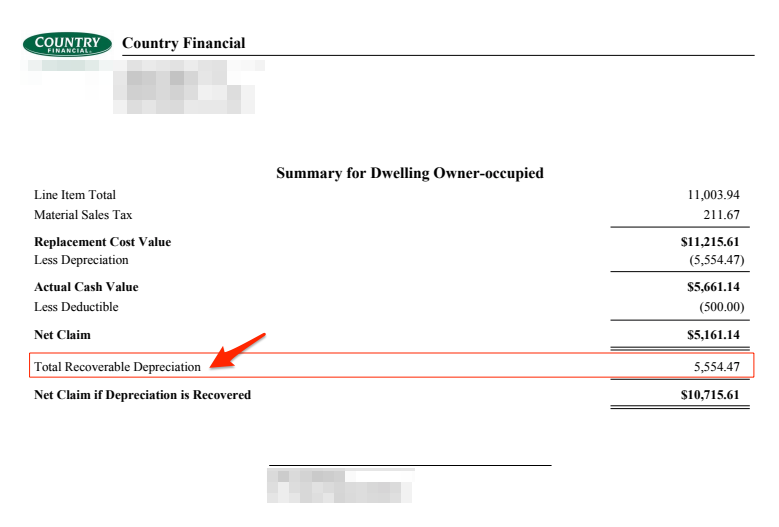

See below image that shows details, and identifies “Total Recoverable Depreciation”:

If your depreciation is recoverable then you will need to spend the amount that your insurance adjustment indicates as the Replacement Cost Value of the repairs/replacement in order to receive the full recoverable depreciation. Good Shepherd Roofing accepts the Actual Cash Value payment, including the deductible, once the roof is substantially complete, and as a courtesy, waits for the client to receive the recoverable depreciation.

A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you. The invoice may indicate any payments, however, the total payments and remaining balance must equal the Replacement Cost Value in order to receive the total available recoverable depreciation. The insurance company will only send you the recoverable depreciation that you are invoiced for – they do not reward their insured’s for saving money.

Here’s an example:

A home insured for $200,000 has a totaled roof from a hail storm, and the cost to replace the roofing system (Replacement Cost Value) is $10,000. In this example, the roof is 15 years old and the policy owner’s deductible is $1,000.

The full replacement cost of the roof is $10,000.

The insurance adjuster “depreciated” the roof 50% – an arbitrary number – based on its age, so the Actual Cash Value of the roof is now $5,000. The recoverable depreciation also happens to be $5,000 ($10,000 replacement value less $5,000 Actual Cash Value).

The policy owner’s deductible is $1,000.

The insurance company will initially make a payment to the policy owner for $4,000. They arrived at $4,000 because the actual cash value is $5,000, and they withhold/deduct the deductible amount of $1,000.

Good Shepherd Roofing will perform the work, and the policy owner will make a payment of $5,000. The $5,000 comes from the $4,000 that insurance company already paid, and the $1,000 deductible.

Once the insurance company has the final invoice for the full Replacement Cost Value they will release $5,000 of recoverable depreciation which will then be paid to the roofing contractor – Good Shepherd Roofing.

Have more questions? We are happy to help! Send us a message or call us at 833-GSR-ROOF.