As Atlanta’s Premier Roofing contractor Good Shepherd Roofing answers calls from all over the metro area from property owners seeking help and assistance regarding leaks, wind damage, hail damage and similar occurrences. For many individuals that have had to make an insurance claim on their property before it is a repeat process and one that they are familiar with. However, there are many property owners that thankfully have not been the victim of storm related damage ( hail damage to roof or wind damage to roof) and have not had to navigate the insurance claim process before. We’ve pulled together the below information as a helpful guide and quick reference for persons wanting more information on an insurance claim for their roof, what to expect and some pitfalls to watch out for.

Table of Contents:

Determining if you should make an insurance claim, how do I know?

The very first step for many folks is determining if you should call insurance or make a claim. Insurance claims on roof are going to be primarily related to 3 key things… (a.) High Speed Winds, (b.) Hail Damage, (c.) Debris Damage That Hits Your Roof (trees, branches, etc.). Check out our blog post titled “3 Major Signs of Shingle Damage That You Should Know” – this will provide you with some good background on what to look for. Also check out our other blog post titled “Why Would Insurance Pay for My Roof Replacement” – this provides some additional hints around making an insurance claim for your roof. In general, when you have damage or even suspect damage you should feel empowered to contact your insurance company. As a professional roofing contractor we always recommend contacting a qualified roofing contractor first as many of the best ones out there will provide a free roof inspection to you to validate storm damage that may be present. When this is done it helps the property owner to be informed about damage that is present. ,BEWARE: Make sure your roofing contractor is providing you an inspection without any strings attached. Sometimes roofers will mask their inspection report in a “contingency contract” that basically says you will choose them if you make a claim. Any reputable contractor should stipulate that they are doing that ahead of time. At Good Shepherd Roofing our inspections are hassle-free. We want customers to choose us because we offer the best products, services and quality in the market…. Not because we’ve locked them into a contract.

Key Steps in the Insurance Claim Process for Your Roof

Table of Content:

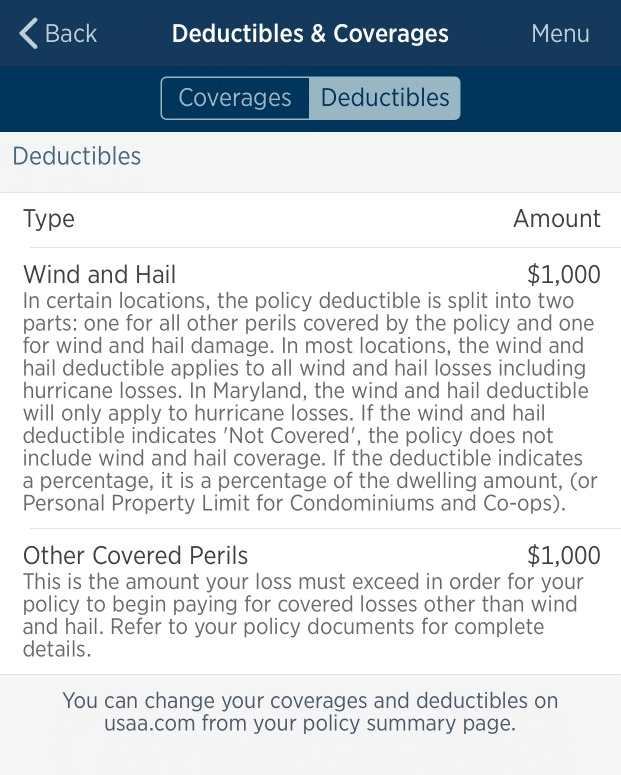

#1 – Review Information on Your Insurance Policy

Pull your home owner’s insurance policy and acquaint yourself with the policy specifics. Some of the key things you’ll want to know from your policy before making a claim include: What is the deductible that is present for your policy? Do you have full replacement cost for the roof, do you have coverage for any depreciation? Does your policy cover any building code updates that may be required to ensure your new roof meets all applicable building codes? (*Helpful Hint: Recently Good Shepherd Roofing has found more homeowners that have been sold homeowner policies that do not include depreciation, these are sometimes called non-recoverable policies. These policies insure the “Actual Cash Value” (ACV) of the roof which is the actual roof replacement cost value minus any depreciation. As a homeowner, it’s our opinion that you will always want to choose insurance for your home that is called “Replacement Cost Value (RCV)” & ensures your home has full replacement done. Here is why: Assume your home’s roof is 20 years old. Because of the materials used and type of shingle it should have a useful life of 25 years (*meaning that the insurance company expects you to be able to get 25 years out of the life of the roof). If the cost to replace your roof as determined by insurance is $15,000 … this would be called the Replacement Cost Value. However, since your roof is 20 years old, it really only has 5 years of remaining life. So guess what, if you have a non-recoverable policy… insurance would only pay you for the useful life that is remaining. In home’s with older roofs this means that the insured has to come out of pocket a great sum to get the roof replaced. So the math works like the following: Replacement Cost Value of $15,000 minus Depreciation of 80% ($12,000) = Actual Cash Value of $3,000. In this example the homeowner gets a check for $3,000 minus their deductible to help on the roof replacement but any amounts that are short they have to cover on their own. In a policy that allows depreciation to be recovered the home owner is able to get full coverage minus their deductible & reclaim the value of the roof’s life that has since depreciated. This is a really important point and one that Good Shepherd Roofing wished was talked about more in the industry.

- Here’s an example from USAA Insurance of deductibles and coverages section from their mobile app.

#2 – Make a Claim With Your Insurance

To make a claim with your insurance you’re going to call your insurance company and let them know that you believe your roof has been affected by storm damage. If you’ve involved a professional roofing contractor, the contractor should be able to supply you with the type of damage that has occurred. If you have made a decision to work with a roofing contractor at this point go ahead and let the insurance company know that. This ensures that all parties are aligned and clear and helps to streamline certain processes and communications. Your insurance company will assign an adjuster and will also generate a specific Claim Number for you. Write this information down, particularly the claim number, and save it as it will be a way to fast track your communications with the insurance company or any questions that come up which may require followup.

You can also reference an earlier article by GSR on Insurance Replacement of a Roof titled “Why Would Insurance Pay for My Roof Replacement?”

#3 – The Insurance Adjustment

Once the claim has been made the insurance company will schedule an adjustment at your home. The purpose of the adjustment is to verify the damage that is believed to be present. During this adjustment it is recommended that the home owner have already chosen a roofing contractor that they wish to work with . During the adjustment the homeowner can then have their roofing contractor present to help point out damage that was observed and to answer questions that the adjuster may have. Good Shepherd Roofing works with State Farm, USAA, Liberty Mutual, Farmers, AllState, Progressive, Auto Owners, Travelers, Safeco and hundreds of other insurance companies and has had great success in working collaboratively with the home owner and adjuster during the adjustment process to ensure the roofing system is returned to a pre-loss condition.

The objective of the adjustment process is to allow the roofing contractor, home owner and adjuster to communicate about what has occurred that is believed to be wind or hail damage.

Example of Hail Impacted on Soft Metal of Roofing System

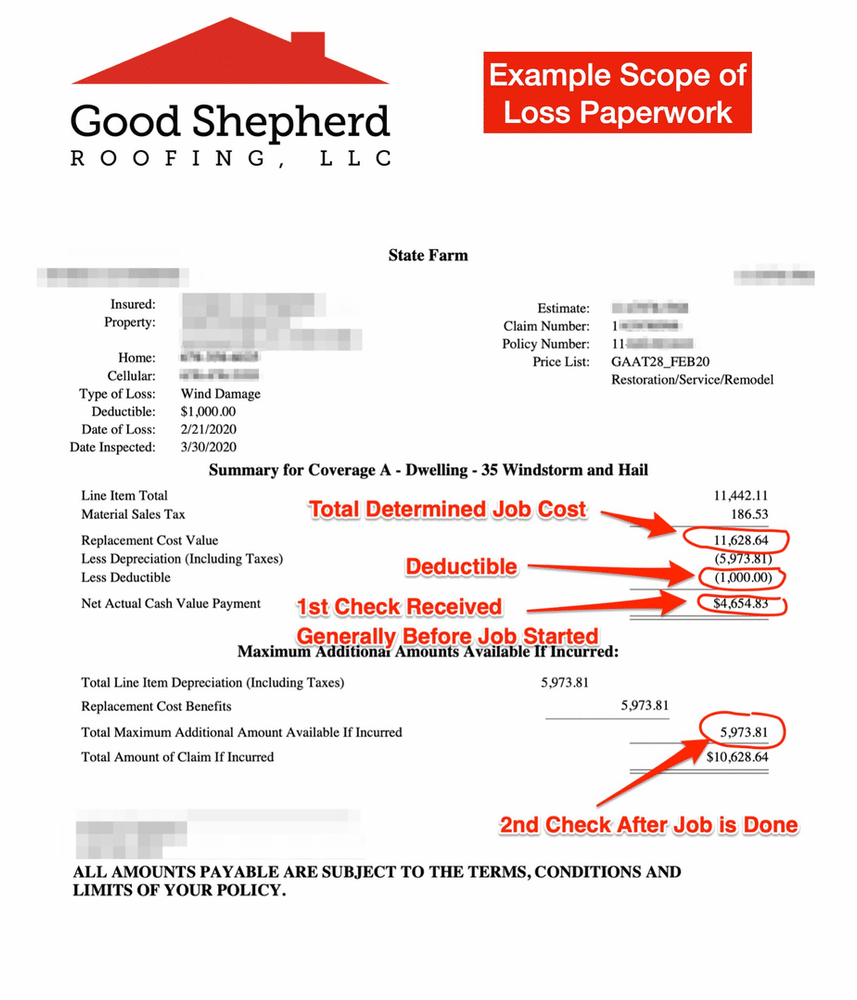

#4 – Statement of Loss

After the adjustment some period of time will elapse while the adjuster submits measurement, findings and pictures from the in-person review of the home or building. This can take from a few hours to a few weeks. It really depends on the process of your insurance company, the complexity of the claim and several other factors. During this time the adjuster and insurance company are identifying what was the scope of the loss that was suffered from the damage. Scope of loss items could include a full replacement of your home’s roof or could be as simple as an insurance company recommending a minor repair. This stage of the insurance process is critical. After the statement of loss is provided the homeowner and contractor can review and determine if all parties are in agreement. A summary scope of loss and final adjustment paperwork is shown below. Notice in the example that a type of loss event is specified as well as the deductible that is present for the policy as well as the date the loss was suffered.

There are a couple key items in the summary scope image below that are worth mentioning:

Replacement Cost Value – As mentioned previously the RCV is the total amount of money that should be paid to the contractor to ensure the items damaged by the storm are put into a pre-loss condition. Remember, the objective of an insurance claim is to ensure the home is restored into same or better condition prior to when the loss was suffered. Many home owners are confused & believe that they need to get several quotes from various vendors, etc. The reality is that the insurance companies and contractors are using a “database” of sorts, basically a standardized price list to agree on what the loss that was suffered should take to fix. This price list, which can be seen in the example below, is a way to ensure that the insurance company and the contractor don’t spend unnecessary time fighting back and forth about should the roof cost $50,000 or $5,000 to be put back into a pre-loss condition. One of the best analogies I’ve heard is this to illustrate the concept. If insurance is paying for your roof do you want to choose the Billy Bob’s Discount Roofing (i.e. the cheapest contractor ) or do you want to choose the company that is going to give you the best experience, the best products, the best warranties and service delivery.

Deductible – This is the amount of money that you are responsible for in the claim. Some insurance companies during the claims process will require you to present a check indicating where you have paid your deductible to the contractor.

Actual Cash Value – The amount of money that is present after depreciation. The concept of depreciation was covered previously and ,,we also have a great article that goes into more detail on recoverable depreciation and related concepts.

Net Actual Cash Value Payment – For homeowners going through an insurance claim scenario this will be the 1st check received. Most contractors upon a successful adjustment and a 1st check received by the home owner will begin planning the installation of the new roof or the repair.

Recoverable Depreciation – After the job is complete, if the home owner or property owner has an insurance policy that covers depreciation, the contractor working in concert with the home owner can send in a completion letter for the roofing job and this will be mailed to the home owner or contractor depending on the setup of the agreement.

Once you’ve reached this stage of the claim process the next part is where having a competent roofing contractor comes in. We at Good Shepherd Roofing have heard too many stories from home owners that have not spent enough time doing their diligence and end up with some horror story or another.

Here are 2 helpful tips to remember when working with a contractor on an insurance claim for your roof.

#1 – It’s real money, treat it as such. Many times, we’ve heard home owners say, “Well insurance is paying for it right, whatever shingle as long as it looks like the ones that are up there now is fine”. Don’t do this. Spend the time to understand how you’re going to get the most bang for your collective buck. As the contractor what materials they use, ask them why. This process is helpful and will quickly help a home owner separate contractors that know their craft and their material from those that don’t.

#2 – Do it right the first time. Hopefully you want have to put on a roof many times in your life. Spend time and get the right contractor so that you know no corners were cut and the system that is put on your roof will stand the test of time.

We know home owners & business owners have lots of choices when it comes to roofing projects. Good Shepherd Roofing takes great pride in helping to educate and inform anyone that we interact with. We hope after dealing with anyone from our team you’ll choose to trust us with your home or business’ roofing project. You

If we can be of assistance to you in filing or understanding the complexity of an insurance claim for your roof please fill out the simple form below.